indiana estate tax threshold

Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there. For more information check our list of inheritance tax forms.

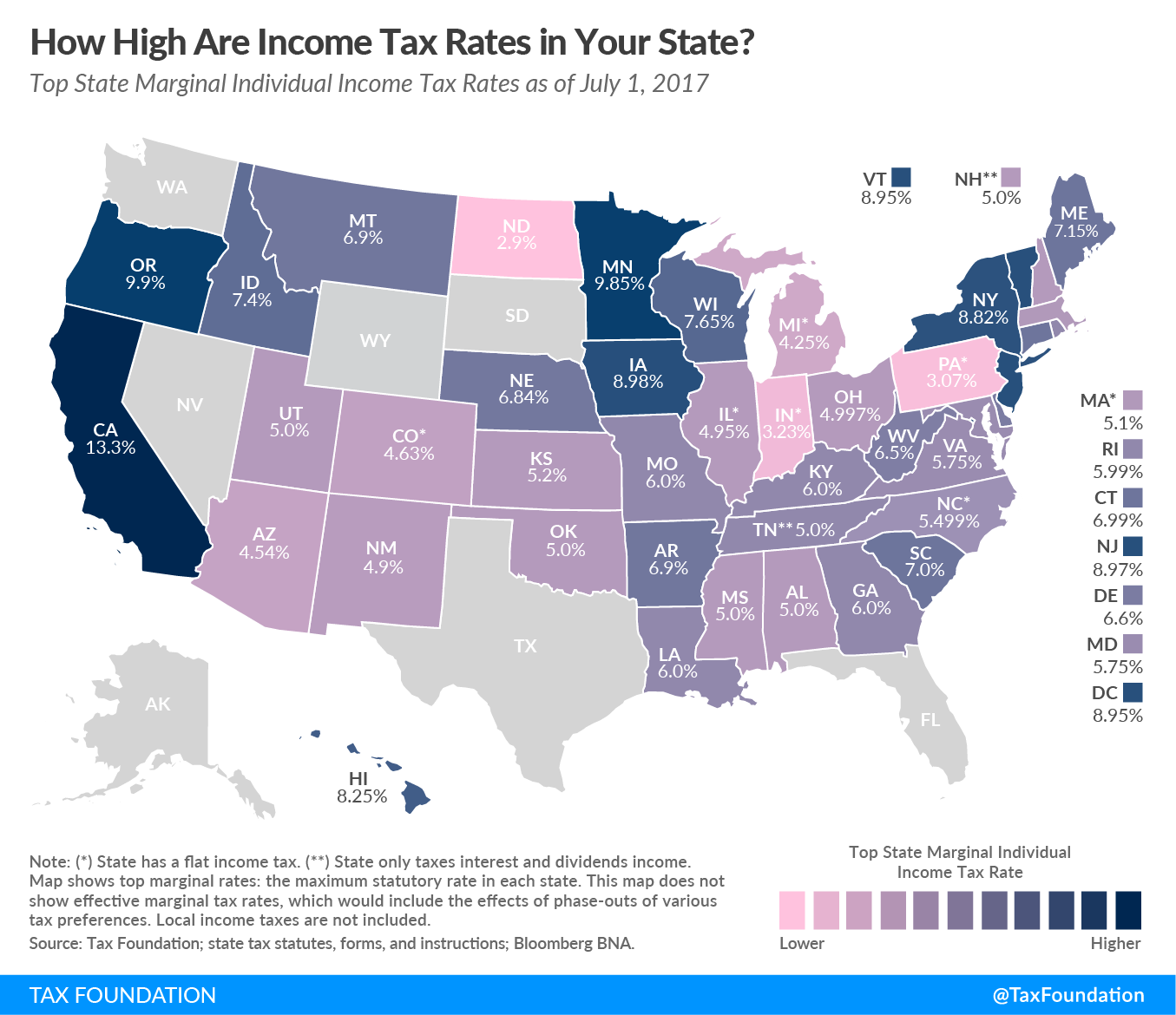

How Do State And Local Individual Income Taxes Work Tax Policy Center

Up to 25 cash back Indiana Estate Planning.

. The Indiana Department of Revenue DOR is set to begin enforcing the states economic nexus law on October 1 2018. A bankruptcy estate of an individual will file form IT-41 with an enclosed copy of the individuals IT-40 Indiana Individual Income Tax Return. Indiana county resident and nonresident income tax rates are available via Department Notice 1.

Understanding the Indiana Probate Process. If you have more questions about sales tax you may call our sales tax information line at 317-232-2240. Homeowners 65 and older who earn 30000 or less 40000 or less for a married.

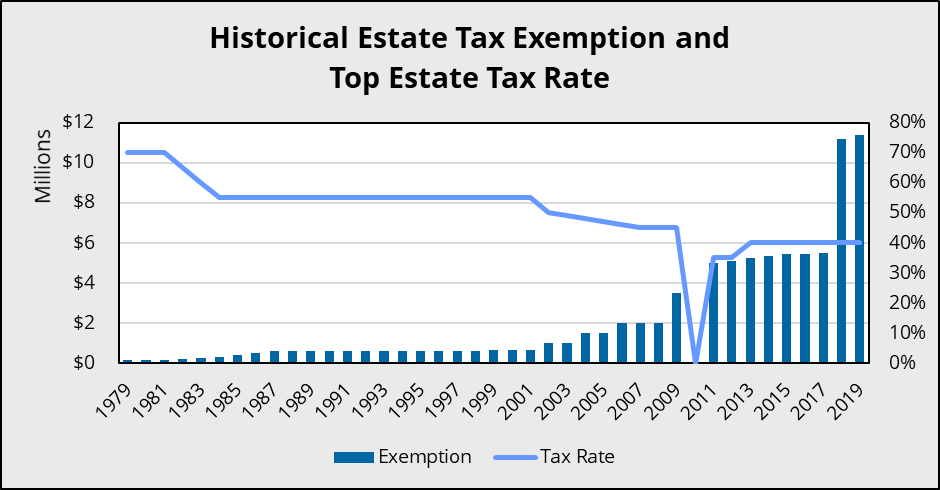

10 of the unpaid tax liability or 5 whichever is greater. Note that for tax years 2020 and 2021 Texas Margins Tax provides for a no tax due threshold of 118 million of gross receipts. The top estate tax rate is 16 percent exemption threshold.

County Rates Available Online. This penalty is also imposed on payments which are required to be remitted electronically but are. Failure to pay tax.

The fiduciary return will report only the amount of. In Indiana the median property tax rate is 833 per 100000 of assessed home value. In Indiana these assets will avoid probate if other assets outside the trust exceed the states small estate threshold.

As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. Example Juanita is opening a computer store where shell sell components parts. Up to 25 cash back Indiana Estate Planning.

Up to 25 cash back The tax rate is based on the relationship of the inheritor to the deceased person. In 2012 the Indiana legislature voted to. The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021.

You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am430 pm ET or via our mailing. No estate tax or inheritance tax. Note that for tax years 2020 and 2021 Texas Margins Tax provides for a no tax due threshold of 118 million of gross receipts.

Therefore no inheritance tax returns must be filed at this time. Does Indiana Have an Inheritance Tax or Estate Tax. Whats the threshold for economic nexus law in Indiana.

That said any merchant may voluntarily register and. Affidavit of Transferee of Trust Property That No Indiana Inheritance or Estate Tax is Due on the Transfer Form IH-TA and notices that life insurance proceeds have been paid to an. Illinois has an estate tax on estates over 4 million.

The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that. All businesses in Indiana must file and pay their sales and. Indiana repealed the estate or inheritance tax for all those who die after December 31 2012.

100000 in gross revenue in the previous calendar year or makes sales into Indiana in more. It doesnt matter how large the entire estate is. Details on the Indiana.

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Estate Tax Definition Tax Rates Who Pays Nerdwallet

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

State Individual Income Tax Rates And Brackets Tax Foundation

Estate Tax Current Law 2026 Biden Tax Proposal

Assessing The Impact Of State Estate Taxes Revised 12 19 06

State Individual Income Tax Rates And Brackets Tax Foundation

Pennsylvania Property Tax H R Block

Inheritance Tax Here S Who Pays And In Which States Bankrate

Estate Tax In The United States Wikipedia

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

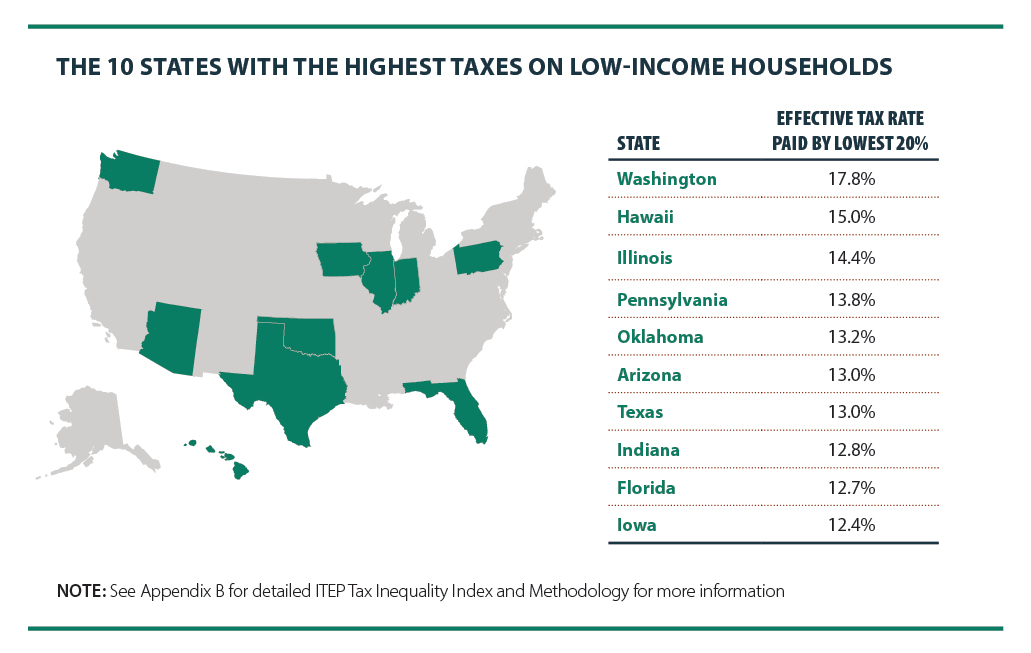

How Racial And Ethnic Biases Are Baked Into The U S Tax System

Estate Tax Implications For Ohio Residents Ohio Estate Planning

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities